Dubai real estate analysis shows Dubai remained a mix bag of activity in May, showing signs of an efficient easing as well as sporadic gains in certain segments. The buzz about 25,000 additional housing units coming into the market in the ongoing year has found little ground, with estimates now putting the number of these new units close to the 12,000 mark. Abu Dhabi on the other hand maintained its smooth sailing, with the real estate market steering clear of rough patches while welcoming several new developments. The ongoing oil price crunch has had little or no effect on a government spending that no more relies exclusively on petro dollars.

Dubai

Although Dubai real estate analysis estimates about new units being added to the market have relieved a majority of stakeholders across the emirate, there remain fidgety landowners who continue to compromise on rents just to keep their premises occupied. Bayut.com noticed that the trend in certain areas had given way to the notion that rents were on the decline across the market. It also fanned talks of “off-grid” deals and brought criticism RERA’s way. But we observed that off-grid deals – owners agreeing to rents outside RERA guidelines – were true in cases where either the anxious owners gave in to speculation about void periods or in areas where new units are already under development and tenants are likely to get fresher stock of offerings.

RERA also found itself at the receiving end of analysts’ jabs regarding its rental increase calculator, with many saying it did not reflect the prices prevalent in the market. The criticism, we think was a little overdrawn. However, RERA has since revised its index in certain cases and we believe it will take further measures in the days to come to make the calculator more effective.

The price changes in the Dubai market are attributable to a number of factors that we analysed. The first reason is the easing away of the speculative pricing layer that accompanied the upwards trajectory of the market. A heightened demand over last two years did drive prices up rampantly, but as usually happens in demand-driven markets, the values correct themselves in the coming periods of stabilization.

Secondly, the regulations by Dubai government imposed last year to ease speculation and avoid market overheating have started to bear fruit. The effects of mortgage cap and hike in registration fees have now become pronounced and are pushing the market towards stabilization, while helping it lose some of the excess weight it put on earlier.

The third reason is the global period of slow growth as forecast by IMF. In comparison of March 2014 to March 2015, prime real estate in global power houses like New York and Singapore lost 4.4% and 12.6% of value, respectively, compared to only 1.1% in Dubai.

Fourthly, the strengthening of dollar against the sterling and other currencies – Indian, Pakistani – has consequently made the dirham more expensive, effecting the buying decision and subsequently hampering demand. The oil price crunch has also affected demand from Russian, South American and Saudi investors, whose wealth has lost value due to the global crisis.

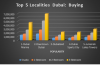

Although these factors contributed to price and rent correction in the market, there were areas like Deira and Karama that registered rental gains on the back of a strong demand. High-end areas like Dubai Marina and Downtown Dubai have maintained their allure to the luxury seekers for now, and values there remained steady apart from marginal fluctuations. The secondary apartment market, however, remains prone to value changes as it is in this segment that most new units are expected. Still, returns from large to small apartments in Dubai range from 5% to 7.5%, while those in cities like Hong Kong, Singapore and London average somewhere between 2% and 3.5%.

The apartment buying market is likely to see a burst of renewed activity as developers close in on launching projects aimed at low income households and tenants look to make the jump to home ownership.

Though the outlook for apartment category remains majorly positive thanks to a growing job market and subsequent rise in population and housing demand, the villa market is likely to face pressure as a result of a heightened supply. About 4,000 new villas will join the existing stock over the course of 2015 alone and the secondary villa market is likely to feel the heat. This means owners of villas upwards of AED 5 million will not only be affected by additional supply but also by mortgage figures. Loan-to-value ratio change to 65:35 past the 5 million mark from 75:25 below it. Still, activity is abundant in the AED 3 million to AED 3.5 million range.

Abu Dhabi

With expectations from the oil sector of Abu Dhabi remaining low throughout 2015, the fifth month of the year saw the real estate market gaining foremost importance. The Abu Dhabi Planning Council approved 76 projects last year and the figure was more than 30 in May 2015, a commendable figure noticing the prevailing crunch of oil prices and increases in utility charges.

Amongst the approved projects were the master planned developments spanning across approximately 11 million square metres of gross floor area (GFA) of Abu Dhabi. Among the more notable project launches in the capital were the two launches on Al Maryah Island – Sowwah Central Mall and Maryah Plaza – along with various developments on Yas, Sadiyaat and Reem Islands. Numerous mixed-use developments outside the central city were also approved with developers promising to begin work as soon as possible. Al Ain launched 3.8 million square metre mixed-use development Wahat Al Zaweya along with World Desert Oasis to cater to the increasing demand of housing and recreational facilities.

The government launched new laws regulating real estate under which rights of buyers were secured regarding the off-plan properties, specifically. The law also announced the preparation of a real estate registry that would save all documents and data related to real estate development along with the creation of a project guarantee account which would be mandatory on all developers to deposit all funds paid by the buyers of an off-plan project. Apart from that, owing to the slowdown in Dubai, Dubai-based property developers are planning to develop in Abu Dhabi noticing the emirate’s resilient economy.

The emirate continues to plough on steadily through the current year and May 2015 showed stability throughout the property market. The government is also focusing on affordable housing, which will not only provide aspiring homeowners with reasonable accommodation, but also help those sharing apartments or rooms illegally find a space suited to their budget.

Our Take

Considering the rate at which Dubai’s market was growing over the past two years, Bayut.com feels the current slowdown can only be considered a much needed hiatus. The adjustment in prices has put fears of speculative bubble build-up and market over heating to rest and provided a sigh of relief to both the government and analysts who feared another market collapse. The outlook for the market remains positive as the population continues to grow in numbers and we are likely to see the demand for accommodations and commercial spaces resurging in the near future. With prices getting competitive by the day and prospects of a heightened demand very much assured, now could be good time to hunt for a bargain that one was so inclined to find earlier. The focus on affordable asset class must be persisted with, as it would not only open up the market to a great number of investors with shallower pockets, it would also let a large number of expats find a decent dwelling at affordable rental cost.

Abu Dhabi is likely to see more and more activity now that the government has taken steps to regulate the real estate market. This is likely to lure many an investor to the emirate who will feel more confident about their investment’s security.

The realty in the two emirates is buoyed by governments willing to take the right decisions and enforce the right adjustments to make the whole better than the sum of its parts.

Leave a Reply