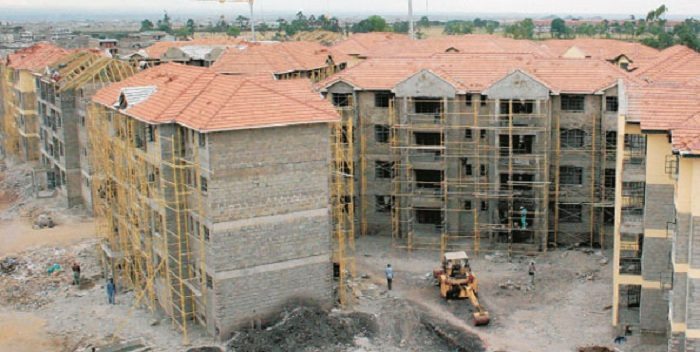

Civil servants in Kenya are set to benefit from a housing program funded by a Chinese private equity fund that will see around 20,000 houses constructed.

This comes following a deal that was recently signed between the government, the China-Africa Development Fund (CAD-Fund) with local housing firm Suraya Property Group and China Civil Engineering Construction Company (CCECC).

State officials have said that the project will help in reducing the difficulties encountered by the government in housing Civil servants in Kenya.

The deal means that the state will offer land on which the housing units will be constructed by CCECC, with funding from the CAD-Fund.

“The partnership is such that the government provides land, we provide consultancy, and the CAD-Fund and CCECC provide funding and also provides construction. The government also manages the end products,” said Suraya Group CEO Pete Muraya after the signing ceremony in Nairobi.

“We are also addressing all types of housing, where we are targeting maybe a million shillings or less and we are going up to the senior civil servants who may want, maybe a bigger house on a quarter of an acre,” he added.

The building of the 20,000 housing units could help reduce the shortage of shelter for civil servants, especially in Nairobi.

The project mainly targets the civil servants, police, military, parastatal officials and workers of county governments.

But the Cabinet Secretary for Transport and Infrastructure James Macharia admitted there is a huge housing shortfall.

“This project, we believe, is very timely. It will be a catalyst for many other projects,” Mr Macharia told an audience at the Crowne Plaza.

“Joint ventures and public-private partnerships can help bridge the gap. For us in government, we shall provide enough incentives, and we need all these partners to compliment and support our efforts.”

The shortfall in housing in the country means Kenya requires at least 200,000 housing units every year.

However, the cost of construction has discouraged many would-be investors and only 50,000 units are put up every year, according to the Transport and Infrastructure Ministry

The cost of land in Nairobi, for instance accounts for nearly half the cost of construction, implying that the end products are way too expensive.

Within the government itself, the police force is in need of around 69,000 more houses, yet the government has only constructed 1,000 in the past four years.

The project shows the intent of the Chinese to establish foot in Kenya by supporting their own enterprises.

The CAD-Fund, China’s largest private equity fund that is controlled by China Development Bank, officially opened its representative office in Nairobi on Thursday.

Chi Jianxin, CAD-Fund’s chairman, told reporters the Nairobi office will also be used as a regional headquarters for the eastern Africa region, making it the fourth such office set up in Africa since 2006.

“We do not currently have many investments in Kenya but after the establishment of this regional office. We want to set this Kenya office as the headquarters of the region,” he said.

“It provides a big advantages for Kenya as we can improve the local exports by directly investing in firms here.”

The fund was launched in 2007 as part of China’s “Eight Measures” to venture into Africa by then Chinese President Hu Jintao, following the Beijing Summit on China-Africa Cooperation in 2006.

It had an initial capital of $1 billion (Sh100 billion) from China Development Bank but raised it to Sh500 billion ($5 billion).

The CAD-Fund often puts money in projects run by Chinese firms in Africa even though it traditionally doesn’t hold controlling stakes in those firms.

It has participated in projects around Africa in glass manufacturing, cement (Ethiopia), a power station (Ghana), a port project (Lagos, Nigeria) and an industrial park (Egypt).

Leave a Reply