Amazon is making a high-stakes push into advanced nuclear energy, particularly small modular reactors (SMRs), seeking to directly power parts of its high-demand infrastructure with carbon-free electricity. In recent quarters the company has signed multiple agreements including in hybrid solar and battery storage projects, made equity investments, and revealed plans for SMR-powered facilities. This also signals the technology major’s shift from merely buying clean power toward shaping nuclear infrastructure itself. Amazon’s nuclear energy move is complimented by other SMR projects such as the small modular reactor fuel plant in Tennessee, first of its kind in the US.

Amazon’s Nuclear Energy Landscape in the U.S.

At the heart of Amazon’s commitment is a partnership with Energy Northwest in Washington for the Cascade Advanced Energy Facility. Here, Amazon is working to develop up to 12 SMRs. The first phase targets 320 MW of output using X-energy’s Xe-100 reactors, with an option to scale to 960 MW.

As Amazon continues to transition toward owning and co-owning nuclear generation, the company also unveiled design and rendering plans for Cascade in October 2025. The proposed SMR site is co-located with a new Amazon delivery station, and leverages Energy Northwest’s existing Columbia Generating Station infrastructure. Amazon has secured rights to purchase electricity from that plant.

Amazon also anchored a US$500 million financing round in X-energy to support design, licensing, and deployment of its advanced SMR technology and nuclear fuel (TRISO-X). Construction on X-energy’s advanced nuclear fuel facility, TX-1, in Oak Ridge, Tennessee started in September 2025.

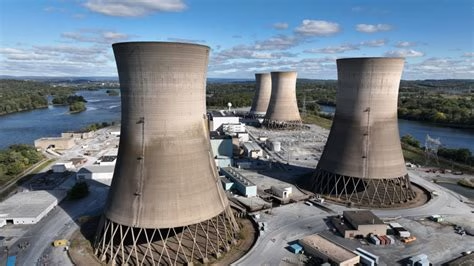

Amazon is also expanding its nuclear footprint with Talen Energy after it signed a long-term Power Purchase Agreement (PPA) for up to 1,920 MW of nuclear power through 2042. This also includes exploring new SMRs on Talen’s Pennsylvania site.

In Virginia, Amazon and Dominion Energy also announced a Memorandum of Understanding (MoU) to explore SMR development at Dominion’s North Anna nuclear power station, targeting 300 MW in initial capacity.

Overview of Amazon’s Nuclear Initiatives in the U.S.

The Cascade Energy Facility in Washington

Amazon plan to develop SMRs near Energy Northwest’s Columbia Generating Station.

The first phase has a capacity of 320 MW, featuring four 80 MW reactors. Optional expansion to 960 MW is also feasible.

Amazon’s Cascade Advanced Energy Facility in Washington revealed renderings and a concept for a facility in October 2025.

As the company also plans to use electricity from these reactors, the flagship SMR facility will complement Amazon’s sustainability goals by powering cloud services and AI infrastructure with clean energy.

X-energy Investment in SMR Technology

Amazon led a US$500 million Series C-1 investment in X-energy to accelerate reactor design, licensing, and fuel development.

Amazon and X-energy also aim to bring 5 GW of SMR capacity online by 2039. This continues to make Amazon’s investment one of the largest corporate commitments to SMRs.

Talen Energy PPA and SMR Exploration in Pennsylvania

PPA to deliver 1,920 MW of nuclear power to Amazon until 2042.

Amazon and Talen also will explore building new SMRs on Talen’s premises, aiming to expand nuclear output.

Dominion’s SMR Exploration in Virginia

Amazon is in a MoU with Dominion Energy to explore 300 MW SMR capacity near North Anna station.

This also aligns with projected 85 per cent growth in Virginia’s electricity demand over the next 15 years.

Amazon’s Play in U.S. Nuclear Energy Sector

While these plans continue to take shape, Amazon’s nuclear goals also continue to fit better into energy-tech trends. This is as seen with the increasing energy demand from AI and cloud services and the growing appetite for carbon-free baseload power by global tech heavy-hitters. But along with investments, comes risks. These majorly revolve around public acceptance. Others span from regulatory issues to licensing delays and policy changes.

Leave a Reply