Why are mortgage rates still so high? And When can Home buyers expect them to drop?

Home buyers, who have endured a year of mortgage rates hovering around 8%, are anxiously awaiting some developments. Optimistic predictions from experts have raised their spirits, suggesting that the interest rate for a 30-year mortgage may potentially decrease to 6% or even lower within this year.

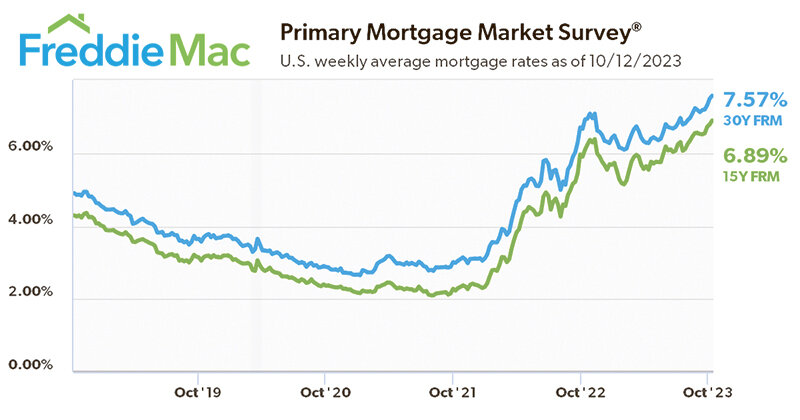

However, there hasn’t been a decrease in rates so far. According to Freddie Mac, the current average for the 30-year rate stands at 6.64%. This is surprising considering that the U.S. Federal Reserve has not increased its interest rate since July 2023 and has even indicated a plan to lower it in 2024. In the real estate sector, experts have been expecting mortgage rates to drop since autumn.

Lisa Sturtevant, Chief Economist at Bright MLS, expressed concern that homebuyers may be disappointed by the fact that the promised lower mortgage rates for 2024 seem to be delayed. A recent survey revealed that 36% of respondents anticipate a decrease in mortgage rates within the year.

Read also: Office-to-Apartment Conversions is booming in 2024. But Where?

While it’s important to note that the Fed doesn’t directly set mortgage rates, its monetary policy can influence them and impact the overall U.S. economy. However, despite easing up on tightening policy due to signals of economic strength and weakness, there is still uncertainty regarding when exactly cuts to the benchmark rate will occur.

This, in turn, brings about uncertainty regarding the timing of mortgage rate reductions that would ‘unfreeze’ the housing market. Homebuyers will likely have to wait until the Federal Reserve takes action before they witness a decrease in those rates.

Read also: Best Ways to Sell Your House in Miami in 2023

Economic Factors Contributing to High Mortgage Rates

According to economists one of the reasons why mortgage rates haven’t decreased significantly is due, to the strength of the U.S. Economy. The job market is still hot, and Inflation levels remain higher, than what the Federal Reserve aims for. As a result people are closely monitoring the inflation report on February 13th. The lack of rate cuts this year can be attributed to uncertainties surrounding the economy. When the Federal Reserve will make its moves as mentioned by Sturtevant.

The positive outlook for the job market brings good news for the spring buying season. ‘While higher household incomes are essential, it is unlikely that mortgage rates will decrease significantly at this stage,’ explained Mike Fratantoni, the economist at the Mortgage Bankers Association, in a conversation with MarketWatch.

Read also: Why Is The Demand For Build-To-Rent Homes Growing?

Furthermore, another reason why mortgage rates remain relatively high is due to lenders’ cautious approach to safeguard against rate reductions. As Cris deRitis, the economist at Moody’s Analytics, mentioned in an interview with MarketWatch, lenders are concerned that if rates were to decline, borrowers might refinance and pay off their loans early. This scenario would limit the amount of interest that lenders could potentially earn.

‘In a way, this anticipation of mortgage rates in the future prompts lenders to adjust their rates today to account for the risk associated with early loan repayments,’ added deRitis.

So when can prospective home buyers expect mortgage rates to drop significantly?

“Homebuyers should expect rates to move lower as we head through 2024,” Sturtevant said. While Fannie Mae expects rates to fall below 6% by the end of the year, other economists, like Fratantoni, expect the 30-year rate to finish the last quarter of 2024 at 6.1%.

But even if rates do drop, that won’t necessarily mean buyers will be better able to afford a home, because a drop in rates could heat up competition for homes even as it boosts buyers’ purchasing power.