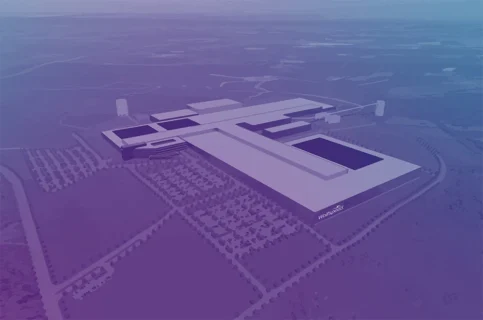

The Wolfspeed John Palmour Manufacturing Center for Silicon Carbide, affectionately nicknamed “The JP” in Siler City, North Carolina, was conceived as the colossal American engine for the electric vehicle (EV) revolution. It was set to be the world’s largest facility for 200mm silicon carbide (SiC) materials, but its ambitions ran headlong into a convergence of unforgiving market and financial headwinds, creating a “perfect storm” that demanded radical action.

To understand the magnitude of what was at stake, the project’s original blueprint called for a staggering ten-fold increase in silicon carbide production capacity compared to Wolfspeed’s Durham operations. The facility was explicitly designed to churn out 200mm wafers—technologically critical units that are 1.7 times larger than standard 150mm wafers—intended to supply the fully automated Mohawk Valley Fab and drastically lower device costs. This aggressive expansion was underpinned by massive financial commitments, including an anticipated $1.3 billion investment just to complete phase one by 2024 and a long-term goal to create approximately 1,800 jobs. Bolstered by a $1 billion incentive package from state and local governments, the site was positioned not just as a factory, but as a publicly funded validation of North Carolina as the epicenter of the clean energy economy.

The Debt Tsunami Hits Shore

The primary element of this storm was a catastrophic corporate balance sheet. Wolfspeed had taken on a staggering amount of debt—ultimately reaching around $6.5 billion—to fund its ambitious global expansion, including the Siler City project and its Mohawk Valley chip fab in New York. This immense financial burden, coupled with high interest expenses, became unsustainable when cash flows failed to materialize as planned.

Market Turbulence Slams the Windshield

Even with a massive new factory nearing completion, external market conditions turned fiercely negative. The expected smooth ascent of the EV market, the main driver of demand for SiC chips, unexpectedly decelerated, particularly in North America and Europe. This “EV slowdown” weakened the appetite for Wolfspeed’s core products. Simultaneously, an aggressive surge in production capacity, especially from Asian competitors, created a market oversupply that immediately led to significant pricing pressures on silicon carbide wafers.

The Manufacturing Paradox: Built But Unused

The third component of the storm was an operational paradox. Wolfspeed’s strategy was vertical integration: the Siler City factory was built to feed massive 200mm SiC wafers to its Mohawk Valley chip factory. However, due to delays in equipment ramp-up and the lack of customer demand, both facilities suffered from costly underutilization. The company was forced to pay the overhead for its world-class, but underworked, assets.

A New Course

The combination of crippling debt, a rapidly cooling EV market, and the colossal cost of running underutilized facilities proved too much for the old Wolfspeed. The financial restructuring was a survival move. It has now emerged from bankruptcy with a cleaner balance sheet, a self-funded plan, and a renewed focus on leveraging the 200mm technology it already built. While production has begun, and initial crystal growth is underway at The JP, the factory’s full ramp-up will be slower and more disciplined, directly tied to the eventual—and hopefully robust—rebound in EV, industrial, and AI-driven demand. The $5 billion facility remains a critical, albeit temporarily restrained, asset in the nation’s push for domestic semiconductor leadership.

WIth tat backgrund elts read on about the project that was to be a leader in inshoring of the EV supply side for the American continent.

Wolfspeed’s $5 billion silicon carbide factory in Chatham County, North Carolina, has faced delays in its planned June 2025 opening due to significant financial challenges that have resulted in workforce reductions. The company has been navigating underperformance in its broader semiconductor business, leading to restructuring measures and cost-cutting initiatives that included staff layoffs and a reduction in operational expenditures. These actions, while aimed at stabilizing the company’s balance sheet, have slowed the ramp-up of construction, equipment installation, and initial production testing, pushing back the timeline for full-scale operations. The delays underscore the high capital intensity and market sensitivity of next-generation silicon carbide manufacturing.

Durham-based Wolfspeed was said to be close to completing the $5 billion semiconductor factory that will be built in Chatham County, North Carolina. Company officials said Friday, February 7 they expect to take full control of the factory by March. Production was to start in June. Construction crews are putting finishing touches on the massive 2.2 million-square-foot plant.

The factory is be located in Siler City, where it will manufacture silicon carbide crystals, a vital component in electric vehicle technology. This project falls under the massive investments North Carolina has secured within the last four years, which include Toyota’s facility in Randolph County and the expansion by Fujifilm Diosynth in Holly Springs. It is among those few projects nearing completion by Wolfspeed.

In addition, state and local governments committed more than $700M in incentives for the project. It has already handed over some money for site preparations, while most of it hinges on Wolfspeed meeting hiring benchmarks set out by the state.

The facility will make advanced 200-millimeter silicon carbide crystals, larger than the company now produces. The sprawling site — about 60 miles west of Raleigh — has room for another 2 million square feet of expansion, said Chris McCann, Wolfspeed’s vice president of global project management.

The factory is one of several semiconductor plants coming up in the USA to onshore semiconductor production, which includes projects such as Micron Technology’s $100 billion megafab in Clay, New York, which recently broke ground in January 2026 and is years away from producing chips (with first fabs expected in the 2028–2030 timeframe)

Current Operational Status (Feb 2026)

Production Readiness: The facility achieved “production readiness” in late 2025. It is currently growing its first batches of 200mm Silicon Carbide (SiC) crystals (boules).

Initial Shipments: The site has begun delivering initial wafers to the Mohawk Valley Fab in New York for chip fabrication, though the Durham “Building 10” facility still handles a significant portion of the primary material supply.

Restructuring Impact: Following Wolfspeed’s financial restructuring and emergence from Chapter 11 in late 2025, the new CEO, Robert Feurle, slowed the original “all-out” expansion. The focus has shifted from completing every square foot to “Operational Discipline”—optimizing the machines already installed to ensure they are profitable before adding more.

Employment

In the long term, the North Carolina factory could employ about 1,800 workers. At the peak of construction, about 3,800 were on site. Testing of some crystal production is underway, and at full capacity, the factory will manufacture and then refine silicon carbide crystals into wafers.

So far, Wolfspeed has hired over 200 employees for the Siler City plant, according to a company spokesperson.

Meanwhile, as North Carolina factory nears completion, Wolfspeed is working in Washington to nail down federal funding through the CHIPS Act. Interim CEO Thomas Werner says keeping the U.S. competitive in semiconductor technology is a bipartisan issue. Werner expressed confidence funding for the project will remain intact regardless of political shifts in the future.

Read also: GlobalFoundries Secures $1.5 Billion Award from CHIPS Act for 3 Projects in NY and VT

Wolfspeed $5B Silicon Carbide Factory in North Carolina: Factsheet

Project Overview

Location: Siler City, Chatham County, North Carolina (60 miles west of Raleigh)

Total Investment: $5 billion

Facility Size: 2.2 million square feet

Additional Expansion Capacity: 2 million square feet

Wolfspeed’s NC Factory Timeline

Construction Status: Final stages

Facility Possession: March 2025

Production Start Date: June 2025

Current Status: Completing final construction with some crystal production testing underway

Manufacturing Capabilities

Primary Product: 200mm silicon carbide crystals

Production Scope: Full manufacturing process from crystal production to wafer refinement

Application: Key component for electric vehicle technology

Employment

Current Employment: 200+ employees hired

Projected Total Employment: 1,800 workers at full operation

Peak Construction Employment: 3,800 workers

Government Support

Total Incentives Package: Over $700 million from state and local governments

Funding Structure:

Partial allocation for site preparation

Remaining funds contingent on meeting hiring targets

Additional Funding: Pursuing federal support through CHIPS Act

Wolfspeed’s North Carolina Factory Strategic Significance

Part of North Carolina’s major industrial development wave

Alongside other major projects:

Toyota facility (Randolph County)

Fujifilm Diosynth expansion (Holly Springs)

Contributes to U.S. semiconductor manufacturing capabilities

Bipartisan support for maintaining competitive edge in semiconductor technology

Read also: Wolfspeed’s $5 billion Silicon Carbide Factory in North Carolina

Leave a Reply