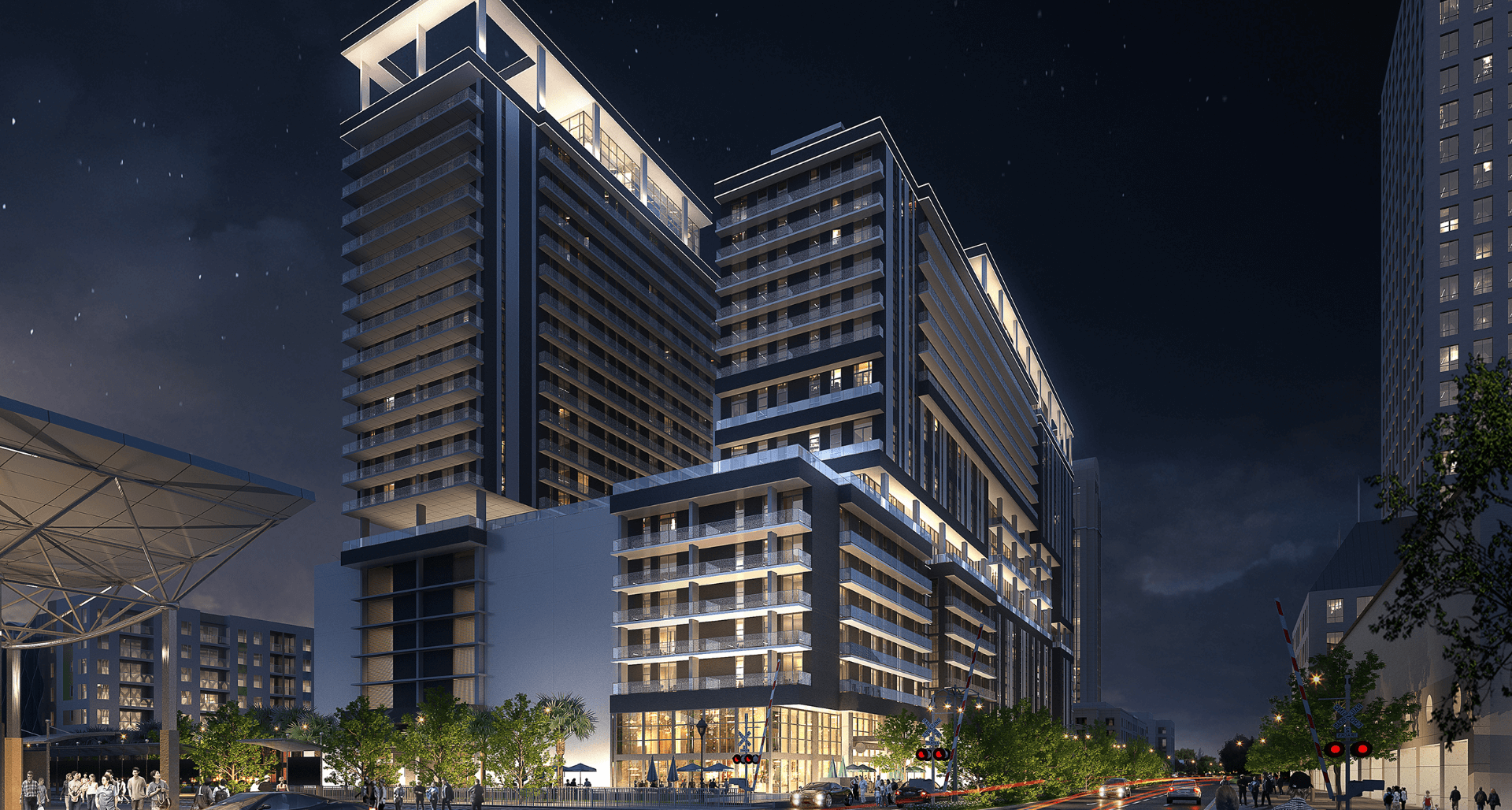

Society Orlando Mixed-Use Tower has secured funding for the rest of the construction process. Raven Capital Management and Property Market Group (PMG) acquired a US$120 million loan for the 26-story retail and multifamily project that is located at 434 N Orange Avenue in downtown Orlando. The loan was arranged through a fund managed by the CIM Group based in Los Angeles, by Mark Fisher and Chris Peck from JLL. The loan will be providing funds for the first phase of the development which began in 2020 and is scheduled to be completed in 2023.

Also Read: Vive on Eola Tower and other construction projects in Orlando

The first phase will include 33,000 square feet of ground-level commercial space and 462 apartments consisting of one-, and two-bedroom floor plans, and co-living units, across a mix of two-, three- and four-bedroom floor plans. The facility will offer a blend of co-living options as well as traditional units. Amenities over a 100,000 square foot area will be provided that will include a pool deck, coworking lab, craft food and beverage operations, gym and fitness studio, yoga lawn, entertainment lounges, smart package lockers, and app-based keys. Additionally, the units will have 502 parking spaces for residents and shoppers. The project, given its proximity to the Lynx Central SunRail station, is designated as transit-oriented development.

The development was designed by Baker Barrios Architects, an Orlando-based firm. Other Society Living developments include Society Biscayne in downtown Miami, which is slated to open at the beginning of 2022; Society Las Olas in downtown Fort Lauderdale, which opened in May 2020; and Society Denver, which was announced in August. More than 8,500 units are also planned nationally including additional developments in Brooklyn, Atlanta, and Nashville additionally. CIM Group is an active lender that, through its CIM Real Estate Credit Strategies business, recently closed a US$135.85 million construction loan for a student housing and parking complex in Houston, Texas.