Whether something looks good, or bad, often (if not always) depends on perspective.

At the time of the Global Financial Crisis, there was a panic across Africa that the markets these countries so depended on would no longer be able to provide source of aid or income for continued development of sub-Saharan Africa (SSA). Questions mounted as to whether the Africa still rising narrative was still valid.As it turned out, debt was the curse driving the GFC and Africa, having the lowest level of domestic and corporate debt, rode the GFC wave better than any other region. A continued growth and mineral demand from China, kept ‘new money’ coming in. This ‘Eastern Promise’ increased the already growing platform across sub-Saharan African governments, for closer ties with the new economic giant.

These are different times and the ‘new money’ connections driving and sustaining African growth are abundantly clear. For the last 10 years we’ve seen increasing waves of Chinese involvement and influence in Africa. Many large infrastructure projects across the continent have been funded by the Chinese government, in exchange for concessions and mining rights. It’s these same minerals and the seeming insatiable demand from China, which has driven up world commodity prices and sustained continued flow of funds and GDP growth into resource rich Africa.

These days, many in of the ‘developed’ world are sleeping better than in 2007/8. China and dependents (much of SSA), on the other hand, are experiencing their own insomnia, driven largely by Chinas stock market collapse and its fall domestic market demand. It’s has been happening slowly since 2012 (which signaled the end of the so called ‘commodity super-cycle’), but accelerated this year.

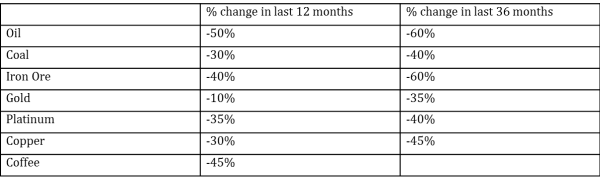

The following table paints a crude picture of how commodity prices have fallen.

Oil producing nations have had a similar ‘shock’ as the figures above show. No-one could have predicted that a drop in world demand for oil would be met by Saudi Arabia’s decision to flood the world market with cheap crude. The purpose, seemingly, as a strategy to undermine the burgeoning shale industry in the USA and as a strike against Iran’s economic influence and also that of Russia (the Saudi’s are no friend to Syria’s Assad).

Some examples below highlight individual countries dependence on certain commodities and make the impact of the price falls self-evident.

1. Nigeria – Oil and gas represent 35% of Nigeria’s GDP but make up a staggering 80% of government revenue. Government budgets were set at an expected oil price of $90 per barrel (it is currently +/-$47 per barrel).

2. Angola’s GDP is made up 46% from Oil and Gas, with government budgets set at $98 per barrel.

3. In Ethiopia, Coffee accounts for 65% of export earnings and accounts for almost ¼ of GDP. 1 in 4 of all 80 million Ethiopians are generate their income form coffee growing or related industry.

4. Tanzanian exports are made up 50% precious metals (mostly Gold) and 25% from Coffee.

5. Mozambique has enjoyed one of the world’s highest GDP growth rates for several year (+/-7%). Key economic drivers have been exports of coal, gold and platinum. All these prices have dropped dramatically.

6. Sierra Leone, three years ago was predicted by the IMF to become Africa’s fasted growing economy. Will drop in iron ore prices, mining investors have now pulled out; leaving SL with the bills to pay for the spending spree that took place based on future income predictions.

7. Uganda’s GDP is made up 24% from agriculture, of which over half is coffee.

8. In South Africa, mining (led by coal, diamonds and gold) accounts for 10% of GDP but a much higher % of exports.

9. Zambia remains dependent on copper mining as largest source of export income.

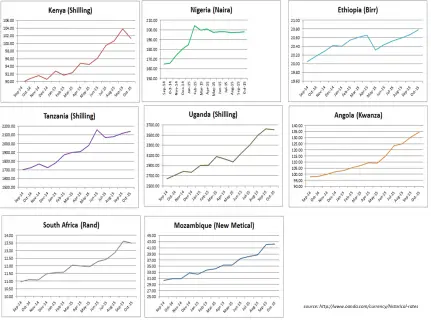

One major and immediate consequence of this tide of misfortune is seen in the exchange rates across African countries (see graphs below).

A fall in the demand for and value of exports, in countries which have high levels of dependency on one or a small number of income streams, can be dramatic as the tables above show. This is not even the full story, because these are only the exchange rates set by the governments and central banks. The amount of FX available through these institutions, at these rates, is limited. In Nigeria, there is an increasingly long list of products that are excluded from foreign currency funds. In Angola, there is a very short list of products that are approved for funds (medicines, some foods). Everyone else has to turn to the so called black market, where rates can be prohibitive.

In Nigeria where the official Naira:US$ rate is 200, the ‘real’ rate fluctuates between 230 and 245. In Angola, the unofficial rate is 2 times higher than the official, making it almost impossible for commercial traders to import.

Governments are not keen to let their currencies de-value due to the impact this has on inflation and the consequent political backlash (inflation on food and fuel are incendiary); but some movement will be necessary, and soon, because the private sector is being starved of business and funds to pay for stocks, wages, bank loans and bills.

The Construction Sector is usually seen as a barometer in any economy. It’s often on the front line when it comes to cuts in expenditure. Across SSA, the industry in 2015 is feeling the squeeze. Lack of funds, whether from government spending or reduced capacity in the private sector, is the primary cause. Secondly, the shortage of (imported) building materials, or where available, their increased price (black market FX rates) is increasing the cost of construction.

Faced with a sudden drop in what had been fast growing development markets, international manufacturers and suppliers are being forced to drop prices and significantly extend payment terms in order to remain not only competitive, but in the market at all. Companies that have extended themselves with high cost operations in SSA are finding their profit projections and ROI disappear before their eyes. Many are pulling out across business sectors:

– Pick n Pay (retail)

– Shoprite (retail)

– Vodacom (telecom)

– Murray & Roberts (construction)

– NOREMCO (pharmaceutical)

– London Mining (mining)

– Anglo American (mining)

– Scania (transport)

-Woolworths (retail)

-British Airways (pulled back)

– Shell Oil (East Africa)

– Nestle (cut back)

– Brunel (recruitment)

– Tiger Brands (consumer)

– Woodside (petroleum)

On the up-side, companies that secure themselves now, will be well placed to ride the up-turn which will inevitably come sooner rather than later; due to the long term demand drivers which remain unchanged (continued GDP growth, rinsing GDP/head population, diversification of economies, improvements in governance, growth in middle income families….and the list goes on).

FDI flows into Africa have been increasing, reaching $87 billion in 2014 (Africa Investment Report). Adrienne Klasa, editor of This is Africa wrote that “Foreign Investors are a growing force and their role is expanding beyond the traditional focus on energy, mining and raw materials. Manufacturing is not the leading business function for foreign investors.”

The Financial Times in a special feature on Africa on 5th October stresses that while the brakes have been applied across the region, the ‘Africa machine’ has not stopped. Like China, it’s just slowed down. Growth in China has dropped to +/-5%, but even at that level; China will increase its GDP every 4 years equal to that of India’s current total. Demand for energy and goods soured from African raw materials will similarly continue to grow.

Getting back to the original point about perspective. We are in unusual times. Although some immediate market opportunities are contracting, this is likely to represent something of an adjustment, rather than the bursting of a bubble. Over the past ten years, investors in Africa have done very well. Much of the mythology around African risk has been debunked. Economies and political institutions across the continent are becoming stronger, sometimes in small steps, but almost always in the right direction). African economies have become integrated into the world economy and what Africa is suffering is really only teething pains.

New equilibriums will be reached in raw material and commodity prices; in exchange rates and inflation rates. FDI will continue to flow into Africa and will become more diversified away from volatile extractive and agricultural industries, into manufacturing and service industries.

Africa is still rising, but more on the ebb and flows of a tide than on the crest of a wave. As Ms Klasa says in her introduction to The African Investment Report, “…two pieces of advice are nearly unanimous. The first is: identify the right local partners. The other is to invest in the long term”.

Leave a Reply