With the rise of construction costs, builders may be underinsured by 30-40% if their insurance valuations don’t reflect recent figures.

Builders and construction companies could face devastating financial losses due to outdated insurance valuations failing to keep pace with skyrocketing construction costs.

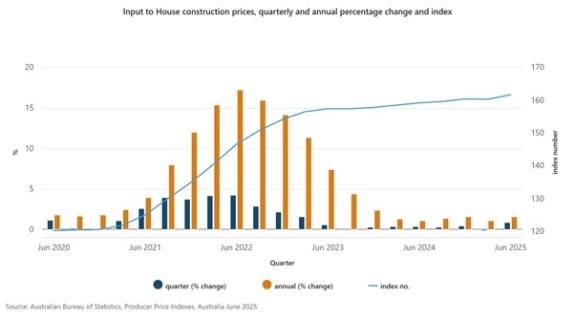

The figures from the Insurance Council of Australia show that building costs have risen by 30% in the last three years and the total increase for the year to February 2025 is 4.3%, showing a rate of increase greater than the current rate of inflation.

Australian construction costs are up by 45% since 2019 with the average cost of building a new home in Queensland being the highest on record, rising from $310,000 to $450,000.

A leading insurance expert revealed many Australians are unknowingly underinsured by up to 40% as building material prices continue to climb at unprecedented rates across the globe.

“We’re seeing construction and rebuild costs climb faster than many policyholders realise,” said Stirling Sanderson, Managing Director at Insuregroup. “If your insurance valuations are based on figures from just a few years ago, you could be underinsured by 30–40% without knowing it.”

“Regular revaluations are essential to ensure that if the worst happens during construction, your insurance will cover the full replacement cost – not just yesterday’s prices,” he said.

This may be due to recent high inflation and increased material costs encouraging builders to raise prices as the aftermath of the supply chain crisis is still felt.

“Policies that haven’t been updated to reflect today’s replacement costs may leave businesses exposed to major financial shortfalls in the event of damage or loss,” he warned.

The unprecedented price increases required to tackle supply chain issues will inevitably be followed by a debate about how to rebuild sustainably. Insurers are already facing questions about the widening cracks in the coverage that this crisis has exposed, as prior valuations become outdated and policies are stretched to their limits.

“Many people set and forget their business insurance, assuming the coverage will be adequate when they need it. But with such dramatic increases in building costs, that assumption could prove costly,” Sanderson said.

He added that professional valuations are particularly important for commercial properties and those with unique or high-value builds.

“Standard indexation may not capture the true replacement cost of the specific property, especially if it has custom features or is in an area with higher than average building costs,” he explained.

The sharp rise in construction costs has created a hidden risk for equipment operators, builders, and property owners: underinsurance. Policies that haven’t been updated to reflect today’s replacement costs may leave businesses exposed to major financial shortfalls.

The Insurance Council of Australia recently highlighted how insurers offer automatic indexation claims to keep pace with rising costs, without actually checking whether they achieve these aims.

Without adequate insurance, builders could find themselves having to fund significant shortfalls out of their own pockets following a claim.

The message is clear: review your insurance valuations now or risk significant financial exposure when you can least afford it.