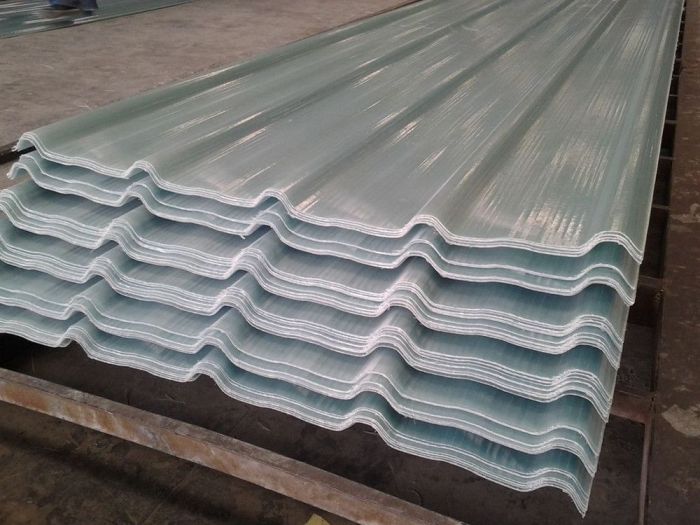

Released data from the Kenya National Bureau of Statistics (KNBS) shows a slow in the production of galvanized roofing sheets in Kenya since 2015. Last year, the production stood at 209,400 metric tonnes.

Also read:Court gives construction of Kenya’s SGR project fresh impetus

This is approximately 2% decrease from the 214,200 metric tonnes sold in 2015.

Apart from galvanized roofing sheets, cement has also been affected as of November last year, at 10.5% to 5.8million metric tonnes compared to the same percentage with even less numbers in tonnes over the same period recorded in 2015.

The decline in demand for galvanized roofing sheets in Kenya has been attributed to the completion of civil works on phase one of the Standard Gauge Railway.

Developers are singling out the use of alternative roofing materials as well as the modern method of construction of flat topped buildings to be a causative factor in the fall of roofing sheet production.

Edelweiss Realtors’ consultant Lucy Githire affirms this and adds that the advent of new technology such as solar tiles and alternative roofing materials like tiles and shingles.

The increase in use of aluminum sheets-iron sheets’ biggest competitor- in the market does not make the situation any better.

The demand for cement is projected to progress gradually with the 120 kilometers second phase of the standard gauge railway projected from Nairobi to Naivasha that is expected to kick off in April.

The approaching election is most likely going to see the Kenyan government accelerate with a view to appease the electorate.This, in turn, could see to the boost of the cement sector.

The real estate sector has surprised many with its bright outlook despite the election set for August this year.

Big players like Cytonn Investments, Knight Frank and Hass Consult remain optimistic about the sector sighting capital inflows as the reason behind new construction work henceforth.

This is confirmed by Hass Consult’s Research and marketing manager stating that long term investments such as those for real estate don’t fluctuate around elections given the long term prospect as well as return projections.