Updated February 2, 2026 – Norfolk Vanguard West offshore wind project off the east coast of England is progressing with development as marine ordnance risk assessment is set to take place ahead of seabed preparation for construction. Two marine license applications were recently filed to begin a bomb search program in 2026 to locate and safely mitigate unexploded ammunition and other buried hazards within the site area. The geographical scope also includes site area around the planned export cable corridor and turbine array. This is to ensure secure infrastructure placement. The same bomb assessment has also been conducted at Vattenfall’s Nordlicht offshore wind site in Germany’s North Sea, completing the farm’s pre-construction safety campaign.

Norfolk Vanguard West, together with its sister project Norfolk Vanguard East have also secured Contracts for Difference (CfDs) in the UK’s Allocation Round 7. The CfDs feature a combined 3.1 GW capacity and strike prices of about £91.20 per MWh. The wind projects are now progressing toward final investment decisions (FIDs) and project finance closure in summer 2026. Commercial operation is also currently targeted for 2029 for Norfolk Vanguard West and 2030 for the East counterpart.

The wind projects were acquired by RWE in 2023 (with the deal completed in March 2024) and are being co-developed with KKR from Vattenfall. They also retained essential permits and grid connections post-acquisition as detailed engineering and procurement phases progress. Once built, Norfolk Vanguard West project, and Vanguard East, will help deliver cleaner renewable energy capable of powering millions of homes as part of the UK’s clean energy expansion. This will be alongside other clean energy installations like Outer Dowsing offshore wind project, and the largest onshore wind farm in England which has been at center of public and regulatory scrutiny. The latter has since been forced to scale back initial development plans.

Norfolk Offshore Wind Project Factsheet

Overview

Projects:

- Norfolk Vanguard West

- Norfolk Vanguard East

- Norfolk Boreas

Location: Southern North Sea, off the east coast of Norfolk in England.

Original developer: Vattenfall

Current developer: RWE

Equity partner: KKR with 50 percent stake across Vanguard East, West and Boreas.

Regulatory framework: UK Contracts for Difference (CfD) scheme and Nationally Significant Infrastructure Projects (NSIP).

Capacity and Scale

Norfolk Vanguard West: 1.4 GW

Vanguard East: 1.6 GW

Norfolk Boreas: 1.4 GW

Total combined capacity: 4.4 GW

Homes powered: Enough electricity to supply around 4 to 5 million UK homes once fully operational.

Norfolk Offshore Wind Project Status as of 2026

Vanguard West and East:

- Secured Contracts for Difference in UK Allocation Round 7

- Progressing through detailed engineering, seabed preparation. Supply chain contracting also underway

- Project finance close and FIDs targeted for summer 2026

Norfolk Boreas:

- Development Consent Order (DCO) in place

- Advancing toward commercial structuring and supply-chain alignment

- Construction sequencing expected to follow Vanguard projects

Expected Commissioning

- Norfolk Vanguard West: 2029

- Norfolk Vanguard East: 2030

- Norfolk Boreas: 2031

Revenue and Market Framework

- CfD strike price for Vanguard East and West: £91.20 per MWh

- Contract length: 20 years

- Market role: Large-scale, fixed-bottom offshore wind providing long-term, price-stable renewable power to the UK grid.

Offshore Infrastructure Components

- Foundations: Fixed-bottom (final selection subject to detailed design)

- Wind turbines: Model and supplier to be confirmed. Also expected to be next-generation 14 MW, or more.

- Offshore substations: Multiple platforms per project for voltage transformation

- Array and export cables: Inter-array cabling and high-voltage export cables to shore

- UXO mitigation: Dedicated unexploded ordnance (UXO) surveys and clearance campaigns planned or underway (notably for Vanguard West)

Onshore Grid Connection

- Landfall: Near Happisburgh, North Norfolk

- Onshore cable route: 60 km underground cable corridor

- Onshore substation: New and expanded infrastructure near Necton, also integrated with National Grid transmission assets.

Geography and Footprint

Distance from shore:

- Vanguard West: 47 km

- Vanguard East: 70 km

- Boreas: 73 km

Water depth: Generally shallow to moderate. This is suitable for fixed-bottom foundations.

Seabed conditions: Sandy sediments with legacy world war 2 ordnance risk managed through survey and clearance.

Project Importance

- Forms one of the largest offshore wind zones in the UK.

- Central to the UK’s net-zero and energy security strategy.

- Anchors long-term offshore wind supply-chain activity in East Anglia.

- Supports grid decarbonization.

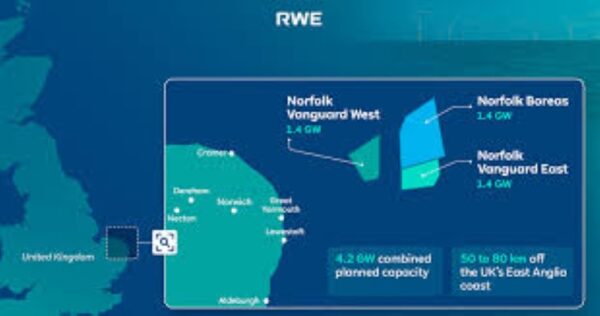

RWE acquires 4.2 GW Norfolk offshore wind project in UK

Reported December 24, 2023 – RWE has finalized a deal to acquire the 4.2 GW Norfolk Offshore Wind Zone projects from Swedish Vattenfall with the aim to resuming development of one of the projects that had previously been halted. Each of the three projects boasts 1.4 GW in the advanced stages of development off the coast of England. The Norfolk portfolio comprises Norfolk Vanguard West, Norfolk Vanguard East, and Norfolk Boreas projects.

A greater portion of the acquisition cost is linked to the expenses incurred up to the present, with the purchase price totaling about GBP 963 million as the enterprise value. With an anticipated closure on the deal for the first quarter of 2024, the completion is only pending approval from The Crown Estate and regulatory authorities.

Also read: RWE AG Commissions 10 MW Solar Farm in Spain

The said projects which have been under development for 13 years, have the seabed rights, grid connections, development consent orders and all key permits in place. Located 80 kilometers off the coast of Norfolk in East Anglia, Norfolk Vanguard West and Norfolk Vanguard East also have had most of the key components secured.

Due to the challenges caused by high inflation, the vulnerability of the offshore wind market, its supply chain and capital costs, the Norfolk Boreas project was paused in July 2023. However, after the acquisition, RWE plans to resume work on the development.

Norfolk Offshore wind project timeline

According to RWE, the three projects are expected to be operational by the end of the decade. In the UK alone, the German company already has 10 offshore wind parks in operation, with one 1.4 GW project under construction and the other nine under development. The next objective is for the three new projects to win a Contract for Difference (CfD) in the upcoming auction rounds.

Tom Glover, RWE’s UK Country Chair, also commended the UK government’s recent decision on future offshore wind auctions which provides the company with confidence to invest and represents a positive step in maximizing the UK’s clean energy potential, ensuring sustained and lower prices for consumers and creating good quality jobs.