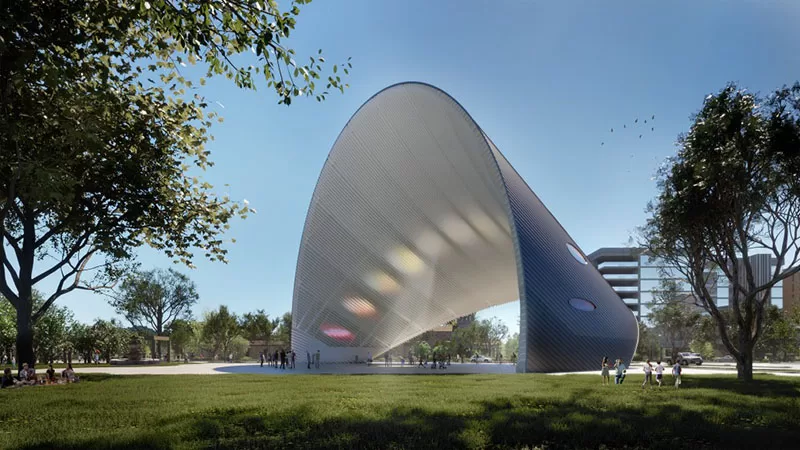

Manson Park in Houston is set to become the location of the Arch of Time which will be the world’s first regenerative solar sculpture. But what is a regenerative solar sculpture? Simply put it is a sculture in the shape of a sundial which will also be able to generate electricity from the sun that will meet the parks energy needs. The sculture will stand 100 feet tall and be located strategically in Mason Park, located in the city’s culturally rich East End.

Many of the renewable energy designs I’ve seen have consisted of elaborately designed wind turbines such as the Whirlers which is a project proposes building a large cluster of colorful wind turbines at Fresh Kills Park in Staten Island that generate electricity from wind. This design marks a definite shift that highlights that what design can do for wind it can also do for solar

The world’s largest freestanding sundial

Designed by architect Riccardo Mariano, the Arch of Time isn’t just a feat of sustainability—it also doubles as the world’s largest freestanding sundial. The sculpture fuses art, science, and renewable energy, producing an estimated 400,000 kilowatt-hours of clean electricity annually, enough to meet all of Mason Park’s energy needs.

Privately funded, the project is part of an ongoing revitalization led by the Harrisburg Redevelopment Authority and the Houston Parks and Recreation Department (HPARD). It’s supported by the nonprofit Land Art Generator Initiative with seed funding from the Acronym Fund, created by Donald and Barbara Tober.

Beyond powering the park, the Arch of Time has a strong educational mission. Council Member Joaquin Martinez highlighted its potential as a tool for STEAM education—science, technology, engineering, art, and math.

“Students will gain hands-on experience by tracking the sculpture’s real-time solar energy output, preparing them for careers in the sustainable industries of tomorrow,” Martinez noted in a statement.

Also Read: Vesper Energy Launches 600 MW Hornet Solar Project in Texas

Electricity generation

Over its lifetime, the Arch of Time is expected to generate over 12 million kilowatt-hours of electricity—offsetting 8,500 metric tons of CO₂. It’s also designed to serve as a resilience hub, capable of supplying backup power to a nearby community center during emergencies.

Set within a broader effort to rejuvenate Mason Park, the project reflects the park’s deep roots in the local community.

“This installation will elevate Mason Park’s legacy and create new ways for people to connect and engage,” Martinez added.