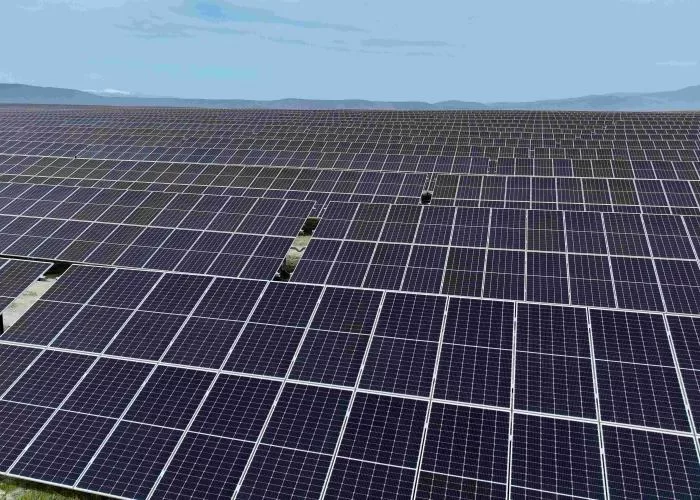

HOUSTON, May 15, 2025 – In a major step toward a carbon-free future, Google has signed a new agreement with U.S.-based developer energyRe to advance its clean energy commitments. The Google renewable energy South Carolina deal involves the investment in and purchase of Renewable Energy Credits (RECs) from over 600 megawatts (MW) of new solar and solar-plus-storage projects being developed in the state.

This marks the second collaboration between Google and energyRe, bringing their combined clean energy capacity to more than 1 gigawatt (GW)—a significant boost to both the region’s power supply and Google’s global net-zero mission.

Over 1GW of Clean Energy to Strengthen the Grid

The new partnership enhances grid reliability while helping to power Google’s expanding infrastructure in the southeastern U.S. The Google renewable energy South Carolina agreement supports the region’s transition to cleaner energy sources and demonstrates how tech companies can play a direct role in transforming energy markets while meeting evironmental and power supply needs at the same time.

“Strengthening the grid by deploying more reliable and clean energy is crucial for supporting the digital infrastructure that businesses and individuals depend on,” said Amanda Peterson Corio, Head of Data Center Energy at Google.

“Our collaboration with energyRe will help power our data centers and the broader economic growth of South Carolina.”

energyRe Supports Google’s 2030 Net-Zero Vision

Miguel Prado, CEO of energyRe, described the agreement as a significant milestone in the company’s mission to develop impactful, utility-scale renewable energy projects.

“We’re honored to partner with Google to help advance their ambitious sustainability and decarbonization objectives while delivering dependable, locally sourced clean energy to meet growing energy demands,” Prado said.

With solar, wind, transmission, and energy storage assets across the U.S., energyRe’s portfolio is designed to meet rising electricity needs, lower consumer costs, and contribute to national decarbonization goals—including those linked to the Google renewable energy South Carolina initiative.

Previous Deal Laid the Foundation

This agreement builds on a 12-year power purchase agreement signed in October 2024, under which Google agreed to buy power from a 435 MWdc solar project also developed by energyRe in South Carolina. That project is expected to generate enough electricity to power more than 56,000 homes and was facilitated through LEAP™, a clean energy marketplace co-developed by Google and LevelTen Energy.

Together, these deals form a blueprint for corporate-driven clean energy investment in the region and solidify Google’s role as a leader in renewable energy adoption.

FACTSHEET: Google–energyRe Renewable Energy Partnership

| Item | Details |

|---|---|

| Keyphrase | Google renewable energy South Carolina |

| Companies Involved | Google and energyRe |

| Announcement Date | May 15, 2025 |

| Project Location | South Carolina, USA |

| New Capacity (2025 Deal) | 600+ MW of solar and solar-plus-storage |

| Total Capacity with Previous Deal | Over 1 GW |

| Previous Deal (Oct 2024) | 435 MWdc solar PPA |

| Power Equivalent | 56,000+ homes |

| Purpose | Google to invest in and purchase RECs |

| Sustainability Goal | 24/7 carbon-free energy by 2030 |

| Procurement Platform | LEAP™ |

| energyRe CEO | Miguel Prado |

| Google Representative | Amanda Peterson Corio |